For over a century, our world experienced exponential global macroeconomic growth fueled by cheap sources of carbon-based energy. This snowballed into the corporate world’s laser-focus on generating higher earnings, higher profits, and higher yields—and at times came at even higher costs. Hollywood movies abound depicting this high-flying culture such as the “Wolf of Wall Street”, which parodies—or perhaps even documents – this pervasive “me-first” philosophy towards business.However, we are starting to see a change. Perhaps brought about by the impending threat of climate change and the increasing scrutiny on corporate practices, the tides are shifting with investors and notably younger generations, who are showing an increased interest in putting their money where their values are. These forces converge into the three pillars of Environmental, Social, and Governance measures—otherwise known as ESG.

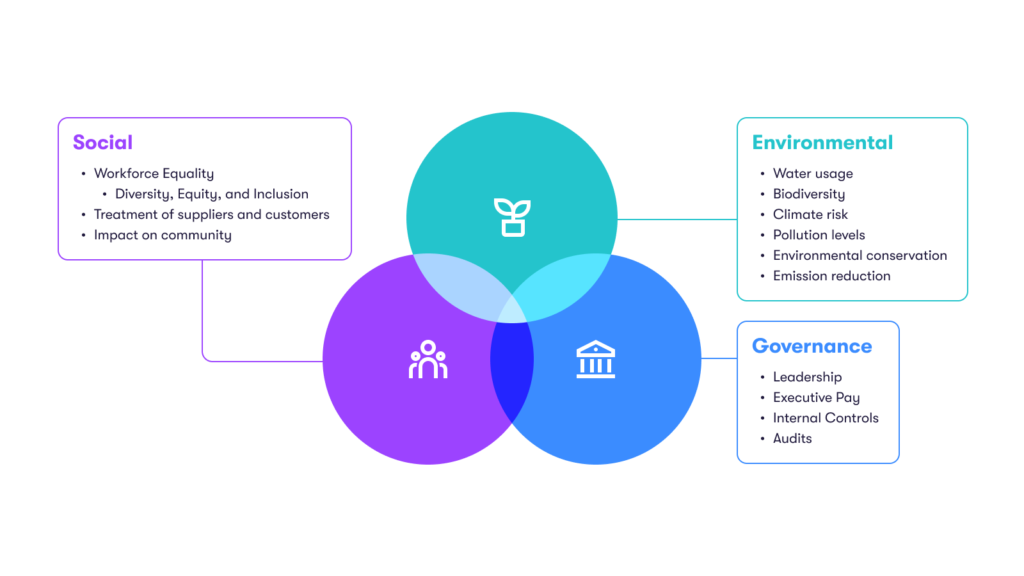

Beyond the buzzword, what is ESG?

Pillar 1: Environmental

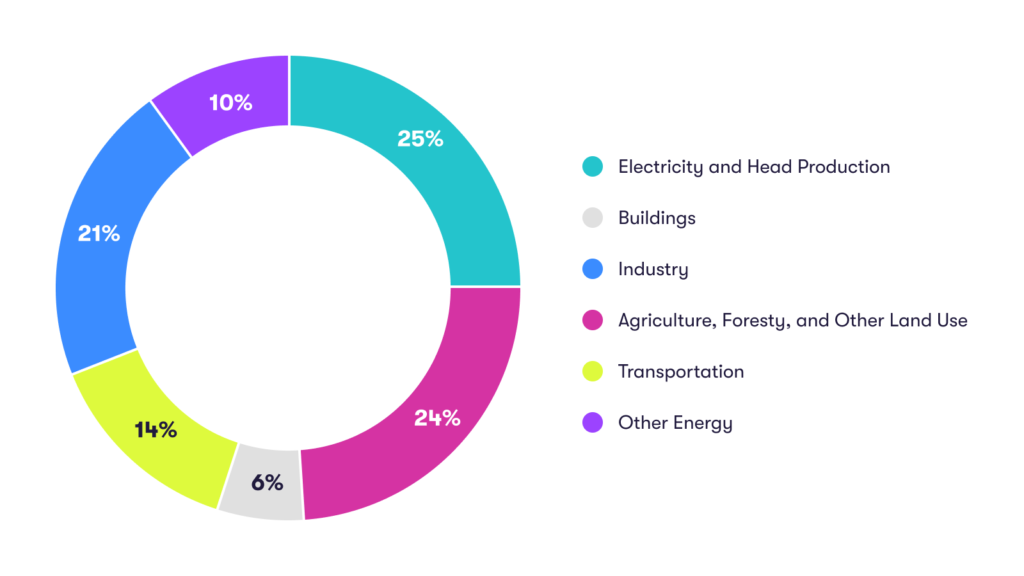

At the recently concluded 26th Conference of the Parties, or the COP26 Glasgow summit held in late 2021, more than 153 countries (or around 90% of the world’s economy across 90% of global emissions) outlined explicit plans to achieve net zero carbon emissions by 2050, followed by China targeted for 2060.

Companies, suppliers, distributors, property developers, and fund managers are following suit by adopting strategies to become climate neutral. In practical terms this means “phasing down coal power, halting and reversing deforestation, speeding up the switch to electric vehicles and reducing methane emissions.”¹

Another notable achievement of the climate pact is the finalization of the Paris Rulebook and the agreement on an ‘enhanced transparency framework’, or common reporting standards of emissions and support. This is a new mechanism and set of standards for international carbon markets, and common timeframes for emissions reductions targets.

Despite this momentum, both public and private companies across many sectors still have a lot of catching up to do in the feverish race to Net Zero emissions.

The positive move towards climate neutrality triggers a domino effect across industries as companies spanning the globe all face the pressure to report on their performance and compliance against this set of ambitious targets.

Pillar 2: Social

What is at the heart of the “S” in ESG? It boils down to how a company manages its relationships with its workforce, suppliers, customers, and the broader society (or societies) in which it operates.

Although arguably an intangible element, social responsibility can greatly impact business and financial performance. There are several considerations a company must take stock of, apart from executing the business-as-usual activities, that will invariably impact shareholder returns.

From a profitability perspective, even if workforce management does not have a direct impact on the bottom line, happier employees tend to be more productive and conversely high turnover rate is more costly as the company will have to continuously seek new hires. A business’ relationship with the community-at-large, including customers and suppliers, can also have a direct financial benefit.

Although arguably an intangible element, social responsibility can greatly impact business and financial performance.

Companies – whether small, medium, or large enterprises – all must take these factors into account while doing business. Complex social dynamics, from trends in online public opinion to company boycotts by different groups, can and do affect long-term shifts in consumer preferences. Leadership must weigh these various non-financial dimensions carefully and make the appropriate strategic decisions.

| Dimension | Considerations & Metrics |

|---|---|

| Workforce |

|

| Suppliers |

|

| Customers |

|

| Community & Political Ties |

|

Pillar 3: Governance

If you follow the markets, you’ll know that corporate governance issues make headlines on a regular basis.

Policies that encourage shareholder engagement and a strong board of directors and senior management, who are both accountable and diverse, are highly desirable.

The Theranos fiasco hitting the headlines in recent years (along with the subsequent digital streaming show that dramatized the events) served as a case study on how NOT to run a company. The fallen unicorn, once valued at about $10 billion, deceived customers and investors point-blank by touting their Edison machine as a revolutionary technology in the blood testing industry. The tech turned out to be non-existent and in early 2022 the US courts convicted the company’s CEO of fraud. Now Theranos is currently valued close to $0.

Governance covers a broad range of corporate activities, including board and management structures, company policies, standards, information disclosure, and auditing and compliance. From an investor’s perspective, they will want to know that a company’s accounting is both accurate and transparent and that its business practices are ethical. Policies that encourage shareholder engagement and a strong board of directors and senior management, who are both accountable and diverse, are highly desirable.

Global Reporting Requirements

Investor appetite for ESG investing has increased, especially on the heels of COP26 pledges and the regulatory pressures that go along with them. Investors, accustomed to scrutinizing the financial metrics of the assets they invest in, will increasingly apply non-financial factors as part of their assessment of potential investment candidates, future growth opportunities, and when identifying significant risks.

With the standards rapidly evolving,more rigorous ESG due diligence will soonbe the norm.

Although ESG metrics are not yet mandatory components of financial disclosure, a number of governing bodies and institutions such as the Task Force on Climate-related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI), and Sustainability Accounting Standards Board (SASB) are working to form standards and define materiality of these risks and measures to take these factors into the investment process.³ The International Sustainability Standards Board (ISSB) was established at COP26 to develop a comprehensive global baseline of sustainability disclosures for the capital markets.

ISSB built upon the prior work of the TCFD and SASB and as of the 31st of March 2022, it launched a consultation for two proposed reporting standards. One sets out general sustainability-related disclosure requirements and the other specifies climate-related disclosure requirements. The aim is to arrive at IFRS Sustainability Disclosure Standards that are intended to provide a global baseline and to be compatible with jurisdiction-specific requirements, including those intended to meet broader stakeholder information needs.4 As of the publication of this article, the consultation process is still open with the ISSB seeking feedback on the proposal over a 120-day period closing on 29th of July 2022.

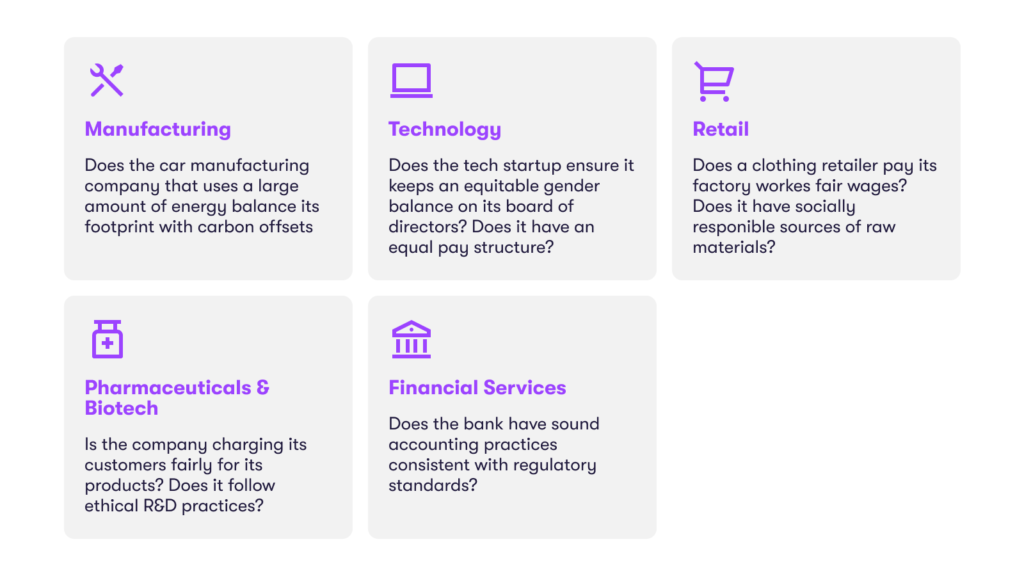

With the standards rapidly evolving, more rigorous ESG due diligence which includes the vetting of companies or asset managers for the ways they account for environmental, social, and governance risk in their organizations or portfolio companies, will soon be the norm. This level of scrutiny will ripple across various industry verticals as companies have to look hard at their multi-faceted practices for which they will be held accountable.

Companies across various industries will be on a race to reach Net Zero—not only to be compliant but also to achieve higher shareholder returns. According to a Fidelity International study, there is a strong positive correlation between market performance and ESG rating.6

As investors focus more on sustainable investing, some companies are tempted to oversell their ESG credentials.

Fidelity International ESG Analyst Survey 20215

In recent years, Exchange-traded funds (ETFs) have grown to be a multitrillion-dollar industry by offering investors access and exposure to a broad portfolio of securities at lower costs. Thematic investments, such as socially responsible ETFs, have risen in popularity notably with millennial investors who look closely at environmental, social, and governance factors in making investment decisions. Capital markets have placed a premium on ESG investing but they have become a recent target of criticism of the US Securities and Exchange Commission (SEC), as it uncovered a list of problems including examples of “unsubstantiated and potentially misleading claims” regarding socially responsible investing (SRI) strategies.

Institutional investors increasingly expect visibility into a company’s practices and results before making investment in companies. To get adequate visibility of this information, they would need to have the right ESG due diligence approach in place to vet how their potential investment stacks up against their benchmarks and targets. We believe that technology will play a pivotal role for both companies and investors to meet these assessment and reporting requirements.

How can Spark help in ESG Reporting?

1. Stochastic Modeling and Stress Testing

To address the “E” in the ESG equation, scenario analysis can be one of the most useful tools for incorporating climate change factors into the investment process. Across different industries, climate risk analysts and actuaries assign probabilities to different possible outcomes. Investors and analysts use these probabilities in scenario analyses to simulate several possible futures in order to assess risk. For example, to simulate the effects of climate change, an investment analyst uses Excel models to project the expected value of an asset or portfolio assuming a 2.0°C, 2.5°C, or even a 3.0°C rise in average global temperatures, let’s say by 2050. Climate-sensitive industries, such as Oil and Gas, might be adversely impacted by COP26 pledges. Analysts use Excel models to forecast different futures for a company or a portfolio to test the sensitivity of returns to several different assumptions.

Perhaps recognizing that traditional risk management approaches are not enough to measure climate risks, banking and capital markets players (and their governing authorities) have turned to stress testing to try to assess the extent of the impact that climate change could have on their positions and their vulnerability to material changes in the environment. These stress tests, usually modelled in Excel, are seen as very useful as they are forward-looking in nature and valued for their flexibility.

So where does Spark come in? Coherent Spark can convert these Excel-based scenario analyses and stress tests into APIs, which can then be integrated with other systems, such as fund management platforms. By using this no-code platform to convert the original logic from the financial analysts into APIs, companies can dramatically improve the months-long, complicated process of interpreting the Excel files and translating them into code. This platform also allows greater security for the models and can give assurance to the analysts that nothing gets lost in the translation to code.

Stochastic models are being used by cross-industry analysts to model severe climate risks that may impact their businesses, investments, and risk portfolios. Stochastic simulation such as Monte Carlo models have proven to be effective tools to analyze uncertainty associated with the direction and magnitude of different impacts over a range of climate futures. In the US, stochastic modeling techniques are being used to quantify the uncertainty related to global warming and sea level changes in 2025, 2050, and 2100 using different assumptions regarding future greenhouse gas emissions and climate sensitivity.7

Excel is frequently used to run these complicated models that require thousands of simulations to cover each policy or investment. Although a powerful tool, Excel has tendency to slow down with weight of all these commands and logic, making this work a tedious and difficult process. Using Coherent Spark to power stochastic models in Excel can enable it to run significantly faster (10 – 100x vs. Excel). Additionally, Spark is a capable, cloud-based tool that automatically scales according to the required processing load.8

2. Tracking and Benchmarking

For the other variables of the ESG equation, social and governance metrics are a mix of both qualitative and quantitative measures. This poses a different set of challenges for tracking, reporting, analyzing, and benchmarking. To complete these activities effectively, a company’s technology stack needs to be ESG-ready. This is especially challenging for asset managers who will need to access and analyze data across the underlying holdings of their portfolio companies.

Coherent Spark’s capable and flexible cloud-based solution, which ingests Excel-based logic can help businesses across industries keep pace with the rapidly evolving ESG space. With industry ESG reporting requirements changing regularly, rigid bespoke solutions will not allow companies to keep up.

Because Spark uses existing tools that analysts and other users are already familiar with – such as the ubiquitous Excel – companies can easily to translate their proprietary, complex ESG-related logic and calculations into APIs within moments. These APIs can then be integrated into internal and external systems such as financial reporting and planning, accounting, internal risk management, CRM, HR, and other systems.

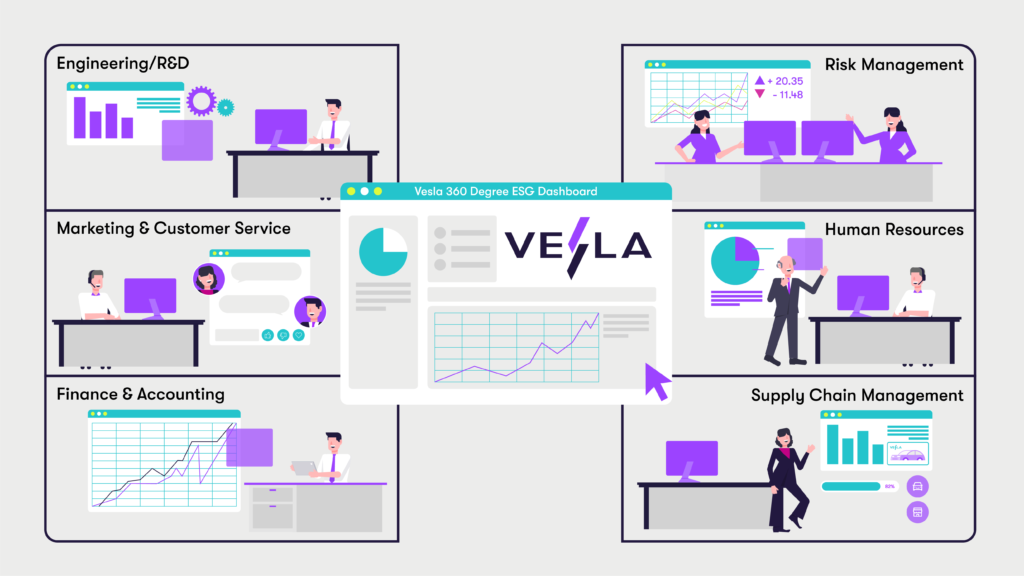

Take a conceptual tour of ESG Reporting for Leading Hybrid Car Manufacturer, VESLA:

The illustration above imagines the theoretical world of Vesla, a hybrid car manufacturer that places great emphasis in its Environmental, Social and Governance performance. Vesla has instilled in its culture the importance of measuring, analyzing, and reporting on its business activities and potential impact across its entire value chain: from supply chain and factory operations, to sales and service. A culture of measuring, analyzing, and reporting its ESG impact within its organization is strongly supported and nurtured.

Powered by Coherent Spark, cross-functional employees are given the ability to track and analyze ESG data in Excel, which is then converted into APIs. These APIs are then connected to other internal and external systems, which can empower VESLA to have a holistic, 360o view of its ESG performance against its goals and model its potential impact to the environment and society at large.

Conclusion

Environmental, social, and governance risks are here to stay. Without proper governance and actions, these risks will continue to escalate. As such, businesses across industries can get a head-start now and accumulate ESG-related skills and talent, develop processes and methodologies, and build or acquire the relevant technology, tools, and systems for data and analytics.

Coherent Spark can be a powerful addition to a company’s arsenal of tools to help report, manage, and analyze ESG risks effectively. Scenario and stochastic analyses, as well as stress testing, will be pillars of supervisory frameworks and should be considered essential capabilities across different businesses in various industries. In addition, the outcomes across the different qualitative and quantitative data that can be surfaced by regular tracking and reporting should be hardwired into companies’ DNA going forward.

Leveraging the data currently housed in existing Excel models, Coherent Spark’s flexible technology can help companies analyze and report on the requirements of the evolving space of ESG and aid in mitigating the risk of “greenwashing”. Coherent Spark can also help guide investors to truly put their money where their ESG values are.

The Coherent Difference

Coherent Spark is here to help companies get a head start with their ESG analysis and reporting.

- Proven no-code approach: Coherent Spark is a no-code solution that uses the world’s most powerful programming language with a decades-long track record and hundreds of millions of users worldwide: Excel. Start converting your existing logic assets to APIs without any code on day one.

- Governance built-in: Best-in-class audit and control functions cannot be solved with a tacked-on process, so Coherent Spark is designed from the bottom up with transparency and compliance in mind. Audit logs, versioning, and access profiles are part of the fundamental structure of the platform.

- Access the power of the cloud: Coherent Spark lets you run logic on AWS, Azure, or other cloud providers without worrying about software architecture, compatibility, or deployment. Run thousands of data points in parallel or ensure system redundancy for key processes without overhauling your models.

- Stay Connected: With easy integration into market-leading, modern SaaS platforms, ensure there are no gaps in your solution implementation. Whether Bloomberg or Salesforce, from data lakes to RPA, Coherent Spark complements and completes the data analysis tools you already use

To learn more about how Coherent Spark can benefit your company’s ESG reporting and analysis, contact us to schedule a discussion with our teams.

References:

- “COP26 The Glasgow Climate Pact”, UN Climate Change Conference UK 2021

- Inter-governmental data on Panel on Climate Change, 2014

- “Climate Change Analysis in the Investment Process”, CFA Institute, 2020

- “IFRS-ISSB Delivers Proposals That Create a Comprehensive Global Baseline of Sustainability Disclosures”, 31 March 2022 (IFRS – ISSB delivers proposals that create comprehensive global baseline of sustainability disclosures)

- “ESG Analyst Survey 2021”, Fidelity Investments, 2021

- “Putting sustainability to the test: ESG outperformance amid volatility”, Jenn-Hui Tan and Benjamin Moshinsky, Fidelity Investments, 2020

- “Stochastic Simulation for Climate Change Risk Assessment and Management”, B.L. Preston, CSIRO Marine and Atmospheric Research

- “Power your stochastic models with Coherent Spark”, Coherent Thought Leadership, by Bob Charles and Henry Chan, 2022 (https://coherent.global/insights/power-your-stochastic-models-with-coherent-spark/)

- “Investments Sustainability Report 2021”, Fidelity Investments, 2021

Isabel Feliciano-Wendleken

Chief of Staff to the Global CEO

Isabel is currently the Chief of Staff to Coherent’s Global CEO. She works alongside the executive team to help develop corporate strategy, manage investor relations, and launch strategic initiatives. Prior to Coherent, Isabel started her career in Wall Street as a strategy consultant and held senior management positions at Deloitte Consulting New York, PwC APAC, and Capco Digital Hong Kong. She has advised Fortune 500 global banking and insurance clients on a range of strategic growth and operational improvement initiatives.

-

This author does not have any more posts.