Do you remember opening your first bank account?

I do. First, I looked up a bank with a branch closest to home. Then, I woke up early the next morning and put on a freshly starched shirt and a pair of well-ironed pants. I arrived at 9:00am sharp, assuming that I would be served promptly if I was there right at the opening time. I was wrong. Four people had the audacity to arrive before the doors had even opened. After an excruciatingly boring 30-minute wait, it was finally my turn. The bank manager guided me to a booth and the clerk slid over a thick stack of forms. Even with the clerk’s guidance, I struggled to identify which questions were relevant to my needs and where I was supposed to sign. In fact, I could barely read the cheaply printed, smudged, tiny font. To make matters worse, the line behind me continued to grow and I could feel the weight of a thousand judging eyes on me. I vowed never to enter a bank ever again.

The Problem with Traditional Banks

Look at the online reviews of traditional banks and you’ll find countless stories of frustration like mine. According to a 2021 Mckinsey study¹, account opening is one of the least desirable processes for customers. Despite these findings, most banks have yet to modernize their processes. Roughly 70% of processes in traditional banks still rely on paper. Opening a bank account or applying for loans often requires customers to sift through dozens of papers riddled with irrelevant questions and hidden signature lines. No wonder there are so many incorrectly answered questions and missing signatures. If the bank’s centralized processing team discovers problems, it can take weeks to resolve them. The team must notify the branch where the form was filled, where a representative must then contact the customer and schedule a time for them to return to the branch to correct the errors. If the bank fails to identify the mistakes, which happens more frequently than you’d think, they face downstream legal and compliance risks.

As such, there are significant drop-offs among potential new customers that scrap their account opening plans as they get frustrated with the tedious, often convoluted paper process. To quote cheesy informercials, “there has got to be a better way!”

Attack of the Neo-banks

The term “Neo-bank” was coined in the early 2010’s to describe a new generation of banking entities that operate entirely on digital platforms. Neo-banks lack the cash and credibility of traditional banks and offer a limited set of products and services. They make up for this with easier banking processes that are simpler, more transparent, and cheaper. This customer-centric approach has proven very successful. The market size of Neo-banks was estimated at USD 47 billion in 2021. Current estimates project this number to grow annually at an average rate of 53.4% until 2030, at which time the value will have reached 2.05 trillion USD.²

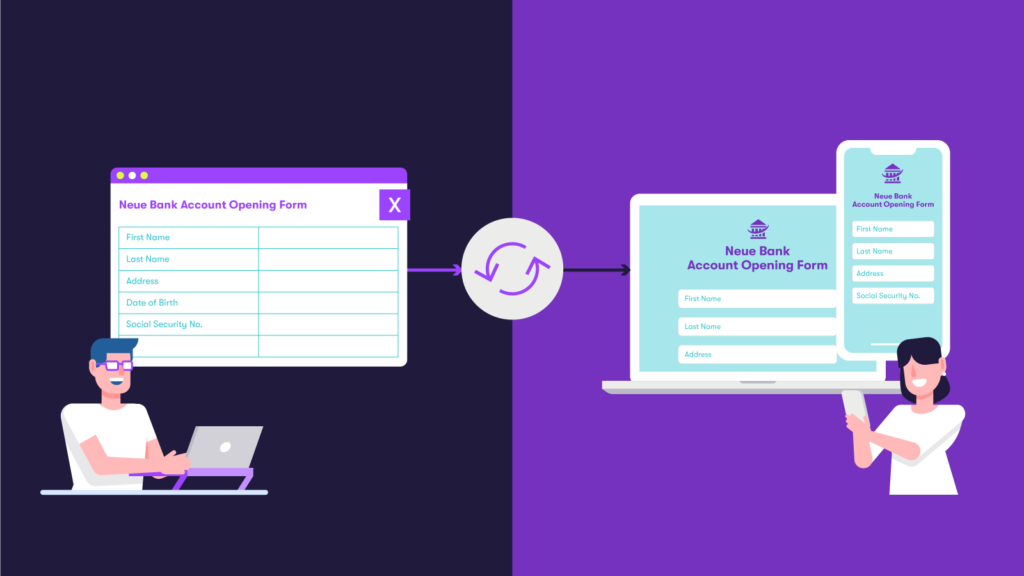

A key element of these new processes is the smart, digital electronic form (e-form). All e-forms begin with a few generic questions. The following pages are dynamic based on the applicant’s answers, asking only required questions and ensuring critical information isn’t missed. Should errors arise, e-forms can immediately identify them and prompt the customer to fix the mistakes.

This conditional logic not only delivers a streamlined experience to customers, but it also provides Neo-banks upselling opportunities. As the application progresses, e-forms can analyze the information provided to predict the customer’s needs and present complementary products and services.

Most compellingly, customers can complete these applications from the comfort of their homes. They don’t need to worry about how far away the bank’s branches are, waking up early, dressing up, or wasting time in a line. Customers can apply for bank accounts or loans anytime, anywhere.

Two Banks, One Challenge

As Neo-banks rose to prominence, raising billions from venture capital and private equity³, traditional banks began to feel the pressure to revamp their digital transformation strategy. Every big bank now invests billions of dollars annually in their digital banking operations. Some have even partnered up with established Neo-banks or created their own Neo-bank subsidiaries to reach historically marginalized customer segments.

However, despite deep pockets and easy access to tech talent, many incumbents still struggle to keep pace with customer expectations. Building e-forms requires both technical know-how and financial domain expertise. Because most financial experts in banks aren’t familiar with coding, they must work alongside developers to create e-forms. The financial experts analyze the product requirements and then draft the form on paper or in Excel. They then pass the information over to the developers who must first take time to understand the logic of the form before they can code it. This not only increases the turnaround time for creating an e-form, but it also opens the process to human error. Furthermore, frequent iterations waste significant time for developers making minor adjustments instead of working on more innovative, value-adding projects.

Ironically, Neo-banks are also beginning to face similar struggles as they expand their product catalog and adopt a more universal bank product strategy. As the lines blur between the service offerings of traditional and Neo-banks they start to have the same challenges.

Coherent Spark: Democratizing Digital Innovation

Both traditional banks and Neo-banks have made great strides over the past five years. However, the current processes for creating digital bank products and e-forms are not scalable. Having developers translate business requirements into code and requiring their help for every minor change is a huge waste of IT resources. There are a number of no-code solutions that claim to fix this problem by giving non-technical employees the ability to build e-forms without having to learn to code. However, it’s difficult to find a tool that adequately covers all the bases. Tools that are simple and intuitive to use offer little flexibility. On the other end, tools that enable the creation of smart e-forms with complex conditional logic require elaborate training.

Coherent Spark’s digital form builder circumvents both of these issues by enabling you to create complex e-forms with conditional logic using a tool that business employees are already comfortable with: Excel! After just a few hours of training, both business and tech employees can create e-forms powered by Coherent Spark without any coding. Spark comes with a variety of built-in features that can cover the requirements of both traditional and Neo-banks. Spark is API friendly, meaning that the functionality can be extended by integration into external tools and systems.

A recent study found that 80% of digital transformation projects failed because the organization lacked a “digital culture”4. In other words, the success of digital initiatives depends on the buy-in from employees. In banks, this means having a streamlined development process in which the finance experts work cohesively with developers instead of being reliant on them. With Coherent Spark, developers only need to integrate the e-form to the bank’s core systems, no manual coding required. Also, because the form logic is built directly in Excel, future iterations can be handled entirely by the finance experts.

Furthermore, Coherent Spark can help mitigate the effects of the growing shortage of developers in the US. The latest statistics by the Bureau of Labor Statistics indicate that by the year 2026, the shortage of engineers in the US will exceed 1.2 million vacancies.5 By integrating Coherent Spark into your existing tech stack and processes, you can decrease your demand for technical resources. This will also drastically reduce backlogs and allow your existing IT staff to divert their talents to more strategic digital transformation projects.

Whether you’re a traditional or Neo-bank, Coherent Spark helps your organization launch and maintain e-forms faster and more efficiently. Empower your employees to build impactful technology with skills they already possess and invest your IT resources more efficiently.

References:

- https://tearsheet.co/uncategorized/banks-slow-as-a-paper-based-process/#:~:text=In%20banks%20and%20insurance%20companies,with%20proper%20equipment%20and%20processes

- https://www.statista.com/statistics/1228241/neobanks-global-market-size/

- https://wup.digital/blog/neobank-threat/

- https://www.bcg.com/en-us/publications/2018/not-digital-transformation-without-digital-culture

- https://crsreports.congress.gov/product/pdf/R/R43061/11

Jay Lee

R&D Analyst

Jay is an R&D Analyst on the Spark R&D team at Coherent. He has worked at both large financial institutions and in growth SaaS startups. At Coherent, Jay works on building new features, testing platform updates for bugs, prototyping novel use cases of Spark, and researching various new technologies/solutions.

-

This author does not have any more posts.

Isabel Feliciano-Wendleken

Chief of Staff to the Global CEO

Isabel is currently the Chief of Staff to Coherent’s Global CEO. She works alongside the executive team to help develop corporate strategy, manage investor relations, and launch strategic initiatives. Prior to Coherent, Isabel started her career in Wall Street as a strategy consultant and held senior management positions at Deloitte Consulting New York, PwC APAC, and Capco Digital Hong Kong. She has advised Fortune 500 global banking and insurance clients on a range of strategic growth and operational improvement initiatives.

-

This author does not have any more posts.

Allan Wong

Head of R&D, Coherent Spark

Allan plays dual roles as the Head of R&D for Spark, Coherent’s proprietary logic and rules engine, and as a senior member of the Actuarial team leading client projects. With an insatiable curiosity and collaborative mindset, Allan is focused on helping Coherent’s product managers find innovative and practical ways to use our ever-evolving technological capability. He believes in insurance and financial services as noble professions, centered in protecting lives and legacies, and is passionate about expanding access to quality products through technology.

-

This author does not have any more posts.